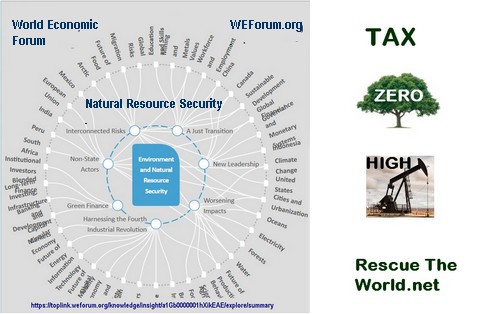

Zero Tax on Sustainables – High Tax on Fossil Fuels, etc. “Carbon tax does not need to be additive – it can be used to offset and lower taxes on sustainable choices.”

Carbon Dividends – a Conservative View; Janet Yellin, former head of the federal reserve, says carbon tax is the most efficient means to handle climate change. The conservative think tank, the Climate Leadership Council CLC, want to see carbon tax paid out as dividends to consumers. The CLC website says rebating all carbon fees directly to the people is the most equitable and politically-viable climate solution.

.

The Nobel Prize in Economics was awarded to William Nordhaus in 2018, for modelling the financial aspects of climate change. Nordhaus also has identified carbon tax and / or carbon dividends, as the most efficient way to modify capitalism in order to address climate change.

Jump to: Rationale or Benefits of $10 gas

LOW (or ZERO) LEVELS of TAXATION

-

- Sustainable use of a Renewable Resource

- Recycling of essential materials

– glass and steel now, lithium in future - Forestry with replanting and remediation of erosion

- Low carbon, low water agriculture

. - Solar, wind, geothermal, nuclear, hydro power

- Electric vehicles and transportation,

including farm equipment - Medical and educational services

- High effciency construction

_____________________________________________________

Jump to: Rationale

MODERATE LEVELS of TAXATION

- Basic consumer goods, or building materials

- Pharmaceuticals and health aids

- Communications infrastructure and devices

- Service industries, such a restaurants

- Railroads and shipping

__________________________________________________

Jump to: Rationale

HIGH LEVELS of TAXATION

- For all Non- Renewable Resource extraction and consumption,

- Mining, oil and gas production and transport

- Industries that pollute indiscriminately

. - Non-physical activity, such as banking, insurance,

and financial instruments.

- Advertising, entertainment and legal services

- Manufacturing and sale of luxury goods

- Airlines and trucking operations

___________________________________________________

RATIONALE

The goal is to move commerce in the direction of a Sustainable Planet. With tax schemes above, entrepreneurial persons will want to move toward low tax / higher profit businesses. Raising some taxes and lowering others makes it tax neutral to the consumer, who will continue to make choices with their wallets.

Conversely, the businesses which polute the planet, and destroy its non-renewable resources, while generating carbon dioxide and other greenhouse gases, should be paying for that damage. This extends the concept of carbon taxes and meat taxes to everything. The goal is to make destructive activities expensive!! The marketplace will take care of the rest.

Worried about the impact on the consumer?

It won’t be so bad. See Benefits of $10 gas

For some ideas on how to participate in a shift to Sustainability Tax in economic principles, please see the page on SOLUTIONS. Ethical or sustainable capitalism is defined there as a combination of global sustainability tax and global human rights in the workplace.

______

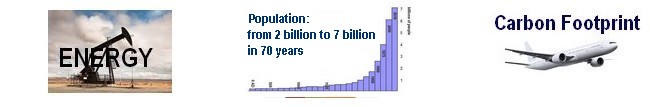

BIOCAPACITY

Everything is driven by commerce, so why not use financial motivations to create a Sustainable Planet? Focus on GDP growth needs to shift to growth in Bio Capacity. In business, “what gets measured, get’s done”. We must change the measures of success.